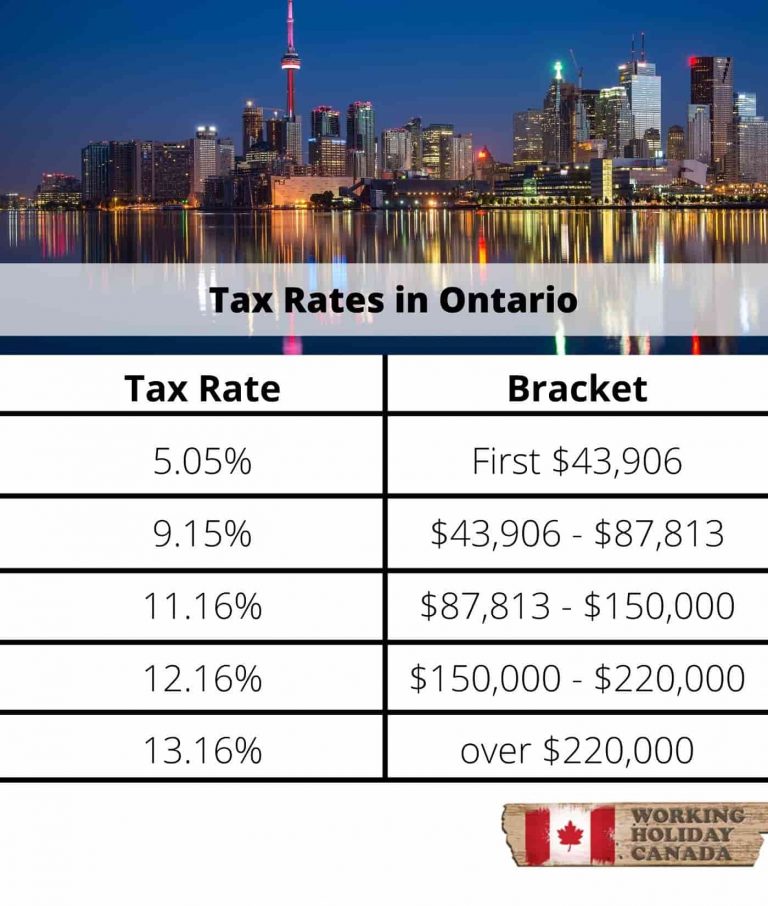

Ontario Income Tax Brackets 2025. The tax is calculated separately from federal income tax. Ontario provincial income tax brackets the provincial income tax system in ontario is a progressive tax system, which means that the more you earn, the higher the tax rate you pay.

Millions of canadians file an income tax and benefit return every year. Ontario’s marginal tax rate increases as your income increases so you pay higher taxes on the level of income that falls into a higher tax bracket.

Ca tax brackets chart jokeragri, Below are ontario’s tax brackets in 2025: Both the federal authorities and every province pick out the tax brackets.

accelerated tax solutions address Held In High Regard Weblogs Gallery, $15,705 (not considered in the table, the gradual reduction of the bpa up to $14,156 from a net income of $173,105 to $246,752). It’s important to note that these tax rates are marginal rates, meaning they only apply to the portion of your income that falls within each bracket.

Payroll Tax Tables 2018 Ontario Elcho Table, The tax rates in ontario range from 5.05% to 13.16% of income and the combined federal and provincial tax rate is between 20.05% and 53.53%. 10%, 12%, 22%, 24%, 32%, 35% and.

75,000 After Tax in Ontario How Much Do You Have to Earn to Bring, Personal income tax is collected annually from ontario residents and those who earned income in the province. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Tax Information Every US Citizen Working In Canada Must Know, Over $150,000 up to $220,000 ; 75,000 after tax in ontario how much do you have to earn to bring, the tax brackets increase each year, based on inflation.

Federal tax brackets 2025 vs 2025 angelsOlfe, The federal basic personal amount comprises two elements: The tax rates in ontario range from 5.05% to 13.16% of income and the combined federal and provincial tax rate is between 20.05% and 53.53%.

Ron DeSantis says he would eliminate four federal agencies if elected, 2025 federal income tax brackets and rates in 2025, the income limits for all tax brackets and all filers The ontario tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.045 (4.5% increase), except for the $150,000 and $220,000 bracket amounts, which are.

Here are the federal tax brackets for 2025 vs. 2025, The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in ontario. Millions of canadians file an income tax and benefit return every year.

What You Ought To Know About The Ontario Tax Brackets, A quick and efficient way to compare annual salaries in ontario in 2025 , review income tax deductions for annual income in ontario and estimate your 2025 tax returns for your annual salary in ontario. Income from $ 51,446.01 :

The Handy Tax Deductions Checklist To Help You Maximize Your, Over $102,894 up to $150,000 ; There are 5 ontario income tax brackets and 5 corresponding tax rates.

2025 federal income tax brackets and rates in 2025, the income limits for all tax brackets and all filers